Unlock Profitable Trades: The Ultimate Guide To Quantitative Stock Analysis

Quantitative stock analysis is a discipline that has gained significant attention in recent years, particularly among traders and investors seeking to gain a competitive edge in the market. This approach involves the use of mathematical and statistical techniques to analyze and predict stock price movements, allowing individuals to make more informed investment decisions. In this article, we will delve into the world of quantitative stock analysis, exploring its principles, methodologies, and practical applications.

The rise of quantitative trading has been fueled by the increasing availability of large datasets, advanced computing power, and the development of sophisticated algorithms. These tools enable traders and analysts to analyze vast amounts of market data, identifying patterns and correlations that may not be apparent to the naked eye. By leveraging these insights, quantitative traders can make more accurate predictions about stock price movements, ultimately leading to more profitable trades.

Quantitative stock analysis is a holistic approach that encompasses a range of techniques, from traditional fundamental analysis to cutting-edge machine learning methods. At its core, this approach is focused on identifying the underlying drivers of stock price movements, rather than simply reacting to short-term market fluctuations. By understanding the underlying mechanics of the market, quantitative traders can develop strategies that are more resilient to market volatility and better equipped to capture long-term gains.

Understanding the Building Blocks of Quantitative Stock Analysis

Before we can begin to apply quantitative methods to stock analysis, it's essential to understand the fundamental building blocks of this discipline. These include:

- Time series analysis: This involves analyzing historical stock price data to identify trends, patterns, and correlations.

- Technical analysis: This approach focuses on visual patterns and chart formations to predict future price movements.

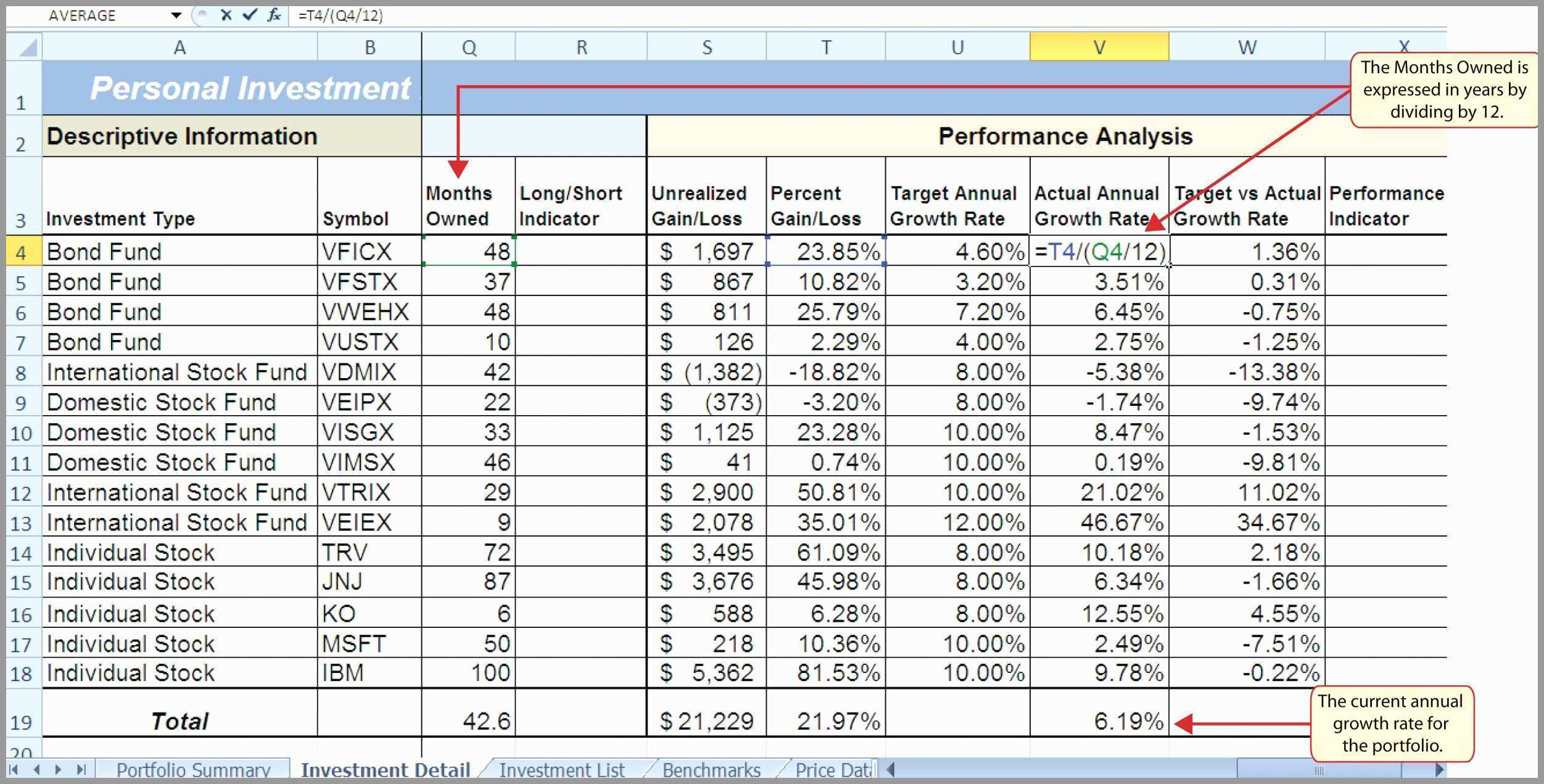

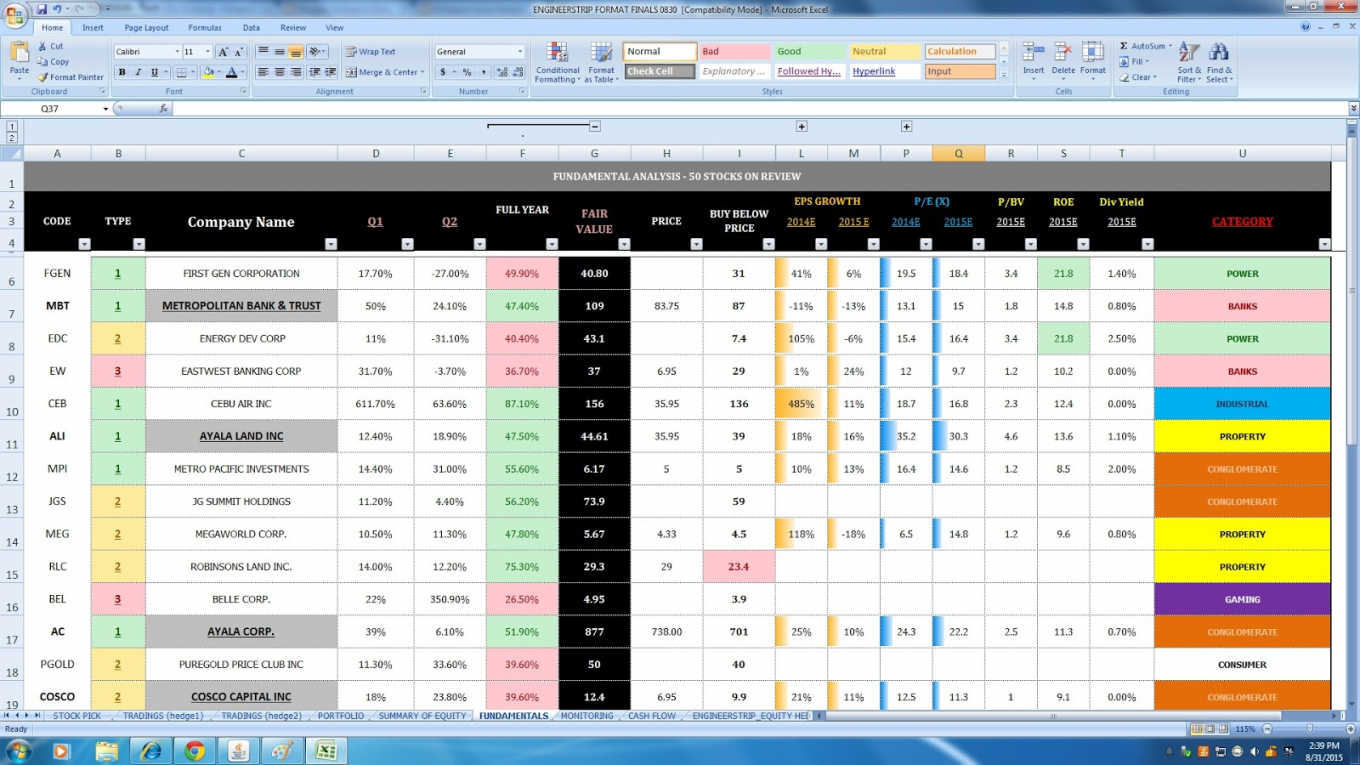

- Fundamental analysis: This involves examining a company's financial statements, management team, and industry trends to estimate its intrinsic value.

- Machine learning: This involves using algorithms to identify complex patterns in large datasets and make predictions about future stock price movements.

Choosing the Right Tools and Techniques

With the vast array of tools and techniques available, selecting the right approach can be daunting. Here are some key considerations to keep in mind:

- Programming languages: Python, R, and MATLAB are popular choices for quantitative trading, each with their own strengths and weaknesses.

- Data visualization tools: Libraries like Matplotlib and Seaborn provide effective ways to visualize complex data sets.

- Statistical software: Packages like NumPy and SciPy offer advanced statistical functions and algorithms.

- Algorithmic trading platforms: Platforms like Zipline and Catalyst provide a comprehensive framework for backtesting and executing trading strategies.

Algorithmic Trading Platforms

Algorithmic trading platforms are designed to simplify the process of building and executing trading strategies. These platforms provide a range of features, including:

- Backtesting: This allows traders to test their strategies on historical data, identifying potential risks and optimizing performance.

- Paper trading: This enables traders to test their strategies in a simulated environment, without risking real capital.

- Execution: This allows traders to execute their strategies on live markets, using advanced algorithms to optimize performance.

Common Quantitative Trading Strategies

Quantitative traders employ a range of strategies to capture profits in the markets. Here are some common approaches:

- Momentum trading: This involves identifying stocks with high momentum, using indicators like the Relative Strength Index (RSI).

- Statistical arbitrage: This approach involves identifying mispricings in the market by analyzing correlations between stocks.

- Event-driven trading: This involves reacting to specific events, such as earnings announcements or mergers and acquisitions.

- Market making: This involves providing liquidity to the market, profiting from bid-ask spreads.

Case Study: A Quantitative Trading Strategy

Suppose we're interested in building a quantitative trading strategy using momentum trading. We'll use the following steps:

- Select a stock: Choose a stock with high liquidity and a history of momentum.

- Define a momentum metric: Use an indicator like the RSI to measure a stock's momentum.

- Identify the trading signal: Use a trigger function to identify when the momentum metric exceeds a certain threshold.

- Set position sizing: Determine the optimal position size based on risk management considerations.

- Monitor and adjust: Continuously monitor the strategy's performance and adjust parameters as needed.

Challenges and Limitations

While quantitative stock analysis offers many benefits, there are also challenges and limitations to be aware of:

- Data quality: Poor data quality can lead to flawed analysis and poor trading decisions.

- Overfitting: Fitting a model to historical data can lead to overfitting, reducing the strategy's ability to generalize to new data.

- Market volatility: Quantitative traders must be prepared to adapt to changing market conditions.

- Regulatory requirements: Quantitative traders must comply with relevant regulations and laws.

Best Practices for Quantitative Trading

To overcome these challenges, quantitative traders should follow best practices, including:

- Using high-quality data: Ensure that data is accurate, complete, and up-to-date.

- Regularly testing and validating: Continuously test and validate strategies to ensure their accuracy and effectiveness.

- Implementing risk management: Develop robust risk management strategies to minimize losses.

- Staying up-to-date with regulations: Comply with relevant regulations and laws.

Conclusion

Quantitative stock analysis offers a powerful approach to trading, providing a data-driven foundation for making informed investment decisions. By understanding the principles, methodologies, and practical applications of quantitative trading, traders and investors can unlock profitable trades and achieve long-term success.

Conor Mason Bellamyisease

Linda Kozlowski

Alex Landi

Article Recommendations

- Fashion Weekti

- Joaquim Valente Age

- Esnglish

- Lisa Liberati

- Dan Hayhurst

- Jyoti Amge

- Massad Boulos

- Massad Boulos Net Worth

- Fareed Zakaria New Wife

- Yvette Prieto